April 30, 2024

By: PhoenixBizz Staff Writer

PhoenixBizz is a division of Sofvue, LLC

Printed with permission of Data Titan and Sofvue LLC

Across the sector, Insurance mobile apps have become a pivotal tool, transforming how insurance companies interact with their customers, streamline operations, and innovate their services. These apps serve various functions, from simplifying the process of filing claims to offering personalized insurance advice, thereby enhancing customer experience and operational efficiency.

One of the primary uses of mobile apps in the insurance sector is for the management and filing of claims. Customers can easily report incidents through the app by uploading photos or videos of the damage, filling out digital forms, and even initiating live chats with agents for assistance. This not only speeds up the claims process but also reduces the administrative burden on insurance companies, allowing them to process claims more efficiently and accurately.

The Rise of AI-modeled Mobile and Web Applications

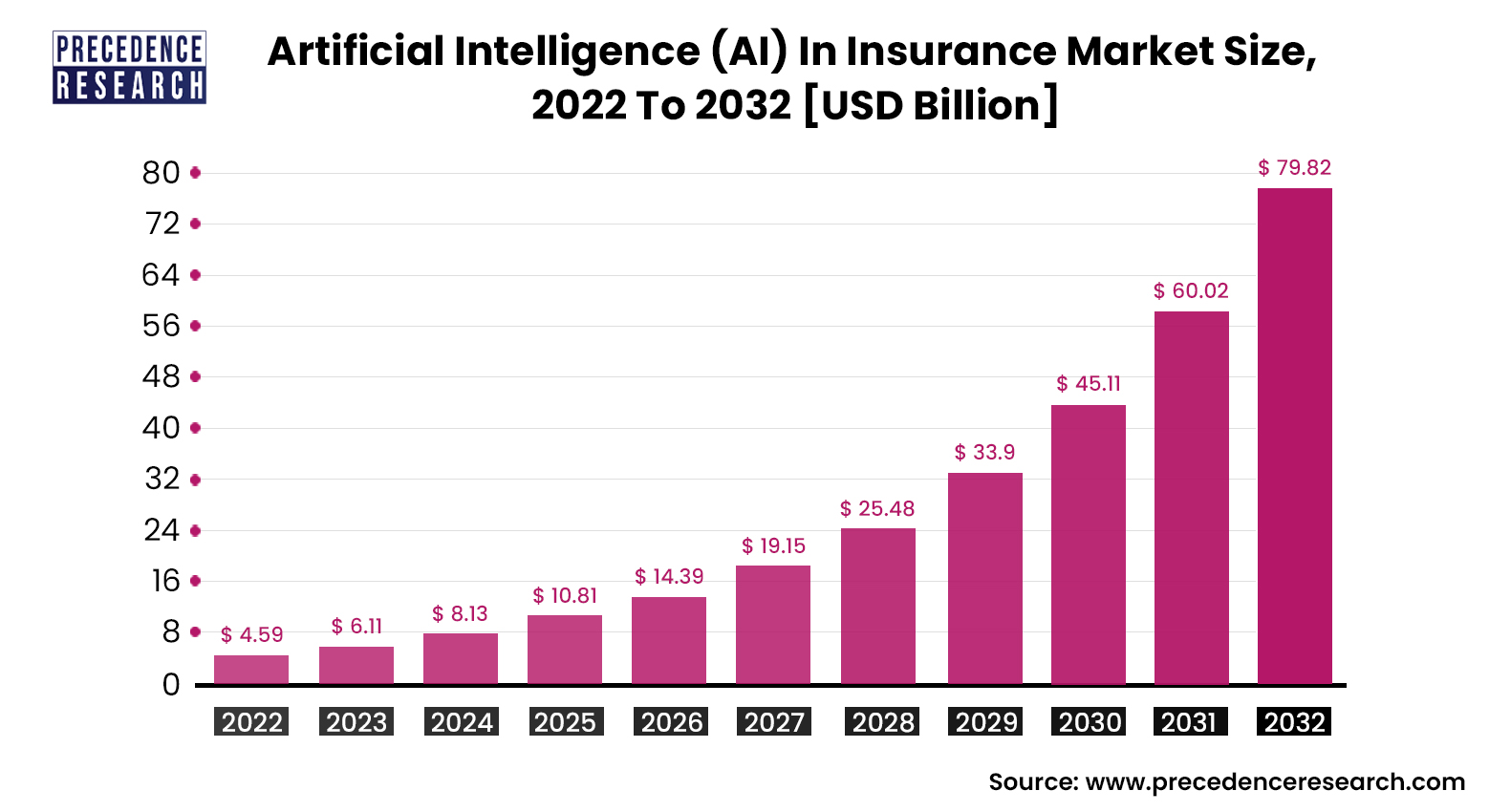

It's undeniable that artificial intelligence (AI) has revolutionized numerous sectors, including the global insurance market. A study by Precedence Research predicts that AI's contribution to the global insurance market will reach $79.86 billion by 2032, with the Machine Learning (ML) segment poised to take a leading role during this period. These staggering figures underscore the growing influence of AI in the insurance sector, positioning it as a pivotal technology for the future. Let's delve into three key benefits that this cutting-edge technology offers to small insurance businesses.

Moreover, mobile apps are being used for policy management and purchase, enabling customers to browse different insurance products, calculate premiums, and buy policies directly from their smartphones. This level of accessibility and convenience has significantly improved customer engagement and satisfaction. Additionally, some apps offer features like storing digital copies of insurance cards, policy documents, and reminders for premium payments, making it easier for customers to manage their policies.

Insurance companies are also leveraging mobile apps to offer value-added services such as telematics and personalized risk assessments. By using data from smartphones or connected devices, insurers can track driving behavior, health metrics, or home safety, and offer customized insurance products or discounts based on the risk profile. This not only helps in accurately pricing the insurance products but also encourages customers to adopt safer behaviors.

Furthermore, mobile apps are being used for customer support and engagement, providing users with 24/7 access to insurance agents, customer service representatives, and informational resources. Through push notifications, insurers can send timely updates about policy renewals, claim status, and promotional offers, keeping customers informed and engaged.

In summary, mobile apps in the insurance industry are revolutionizing the way insurance products are designed, sold, and managed. By offering a blend of convenience, efficiency, and personalized services, these apps are not only enhancing the customer experience but also providing insurers with innovative tools to improve their operations and develop competitive advantages in a rapidly evolving market.

Firstly, AI enhances the customer experience through advanced insurance comparisons. In a vast market, customers value having choices and detailed insights into their options. Traditional methods like scheduling calls for information are becoming outdated. Instead, AI-powered chatbots present a dynamic solution for small businesses, enabling access to up-to-date data on claims success rates, coverage details, premiums, and additional fees. This not only facilitates comprehensive comparisons but also ensures customers receive accurate and relevant information.

Secondly, AI-driven applications offer significant cost savings, a crucial advantage for small businesses operating within tight financial constraints. By automating routine tasks, these applications reduce the need for extensive staffing, thereby lowering operational costs. Additionally, AI can assist in allocating budgets more efficiently across various departments, further enhancing financial management.

Lastly, cybersecurity is a paramount concern for customers, particularly regarding sensitive insurance information. AI can bolster the security of mobile and web applications by ensuring compliance with legal standards and employing data analysis to identify and rectify potential vulnerabilities. This proactive approach to cybersecurity minimizes the risk of data breaches, providing a safer environment for customer data.

In summary, AI is not just transforming the insurance market on a macro level but also offering tangible benefits to small insurance businesses. From improving customer service with AI chatbots to reducing operational costs and enhancing cybersecurity, AI is equipping these businesses with the tools needed to thrive in a competitive landscape.

Must Read: Understanding What’s Needed To Develop An Insurance Mobile App: An Overview

Establishing Confidence Through AI-Enhanced Insurance Applications

People buy insurance primarily as a form of financial protection and peace of mind against the unpredictable nature of life. Insurance policies serve as a safeguard against the financial strain of unforeseen events such as accidents, illnesses, property damage, or loss of life. By paying a relatively small premium, individuals can transfer the risk of significant financial loss to the insurance company. This not only helps in managing risk but also in planning for the future, ensuring that individuals and their families are covered in times of need. Moreover, insurance can be a requirement in certain contexts, such as driving a car or obtaining a mortgage, where it provides a safety net for both the individual and the broader community.

Below are a few reasons why your small insurance firm might want to provide a mobile app for your customer base.

1. 24/7 Availability

As an insurance provider, ensuring you're always available to your customers is crucial. The essence of insurance, rooted in the term 'insure,' is about providing security and guarantees. Leveraging AI can significantly enhance the responsiveness of your mobile or web application, virtually eliminating any delays in communication. This technology enables a proactive approach to customer service, where chatbots are not just advisors but problem solvers tailored to address specific customer issues effectively.

2. Transparency

It's essential to clearly communicate the usage of customer data, especially considering the sensitive nature of the information insurance companies collect. Including an easily accessible 'privacy policy' within your app reassures users of their data's safety, fostering a stronger relationship between them and your insurance firm.

3. Enhancing Customer Convenience

For property and vehicle insurance, moving away from traditional methods of claim investigation, such as physical site visits by agents, to allowing customers to submit photos or videos of damage through an AI-enhanced app, can streamline the claims process. This not only saves time but also positions your firm as customer-centric, prioritizing their convenience.

4. Analyzing Driving Habits

Rash driving and unsafe habits not only endanger lives but also increase the risk of accidents. By integrating a driving analyzer within your AI-powered app, which pairs with the vehicle via Bluetooth, users can gain insights into their driving patterns, including acceleration, hard braking, and fast cornering. This innovative feature not only educates drivers on safer driving practices but also demonstrates your commitment to their well-being, rather than merely focusing on financial aspects, thereby deepening trust and loyalty among your customers.

Innovative Approaches to Integrating AI in the Insurance Sector

1. Risk Assessment Revolutionized

Traditional methods of risk assessment, often too costly and resource-intensive for smaller firms, are being transformed by AI technology. AI-enabled apps level the playing field for small insurance companies amidst a sea of industry giants by utilizing big data analytics. These apps analyze patterns in customer behavior and claim history, leveraging historical data to enhance understanding of risks, thereby streamlining the risk assessment process.

2. Enhanced Personalization

Personalization goes beyond merely sending tailored offers; it's about fostering deeper interactions and relationships with your audience. For small businesses, earning customer trust is crucial, achievable through demonstrating ethical practices and transparency. AI's ability to process data without human biases introduces a new era of fairness in pricing, making insurance more accessible and personalized for every customer.

3. Strategic Loss Prevention

Traditionally, loss prevention strategies have demanded significant investment, often beyond the reach of smaller insurance firms. AI technology offers a solution by automating the risk assessment process, thereby reducing the likelihood of losses. This innovation not only minimizes the financial burden on small companies but also enhances their ability to manage and mitigate risks effectively.

Key AI Innovations Transforming the Insurance Landscape

A 2021 State of Insurance Fraud Technology Study states that 80% of their respondents were using predictive analytics to detect fraud. The number was 55% in 2018. This rapid increase underscores the swift impact of AI and related technologies across various sectors. Here are a few cutting-edge AI trends small insurance firms are leveraging to stay competitive:

1. Robotics

Driven by advancements in innovation and robotics, the manufacturing industry is undergoing a transformative shift towards 3-D printing. This evolution is not just altering production methods but also reshaping supply chains and product development processes. Insurance companies, to remain competitive and significant in this changing landscape, must adapt their strategies and policies to accommodate the unique risks and opportunities presented by 3-D printing technologies. Preparing for this shift is crucial for insurance firms aiming to maintain a strong presence in the evolving manufacturing sector. According to McKinsey & Company, 3D-printed buildings will become widespread, and by 2030, a significant portion of vehicles will be equipped with autonomous features. This evolution necessitates insurance companies to prepare for the new risks and challenges these technologies introduce. It's imperative for insurers to understand the shift in customer expectations that accompanies these advancements and tailor their insurance offerings to meet these evolving needs.

2. Connected Device Data Collection

In the coming decade, we will all be witness to sensor-connected devices. Several industries have been using this technology for years, and experts estimate up to one trillion connected devices by 2025. The surge in data collection through various devices presents a golden opportunity for insurers, especially smaller firms, to gain a deeper understanding of their customers and their needs. By leveraging this wealth of information, small insurance companies can enhance their services in several key areas:

✅ Establish more competitive insurance rates for diverse customer groups.

✅ Tailor insurance plans to meet the specific needs of different audiences.

✅ Offer immediate service to policyholders and illustrate potential risks through AI-enhanced or 3D video call support.

You may also like to read: A Comprehensive Guide for Planning a Custom Financial Software Application System

Conclusion

The insurance sector presents opportunities for both large and small companies, yet smaller firms face stiff competition due to their limited financial resources. The advent of innovative technologies has been a boon for companies seeking to establish a foothold in their respective industries. AI-powered mobile and web applications, in particular, have become a game-changer, attracting investment from companies of all sizes.

For emerging insurance providers with ambitions that surpass their current scale, partnering with the right mobile app development firm is your first key decision point. PhoenixBizz stands out as a premier provider in this arena, boasting over two decades of industry experience. During this time, we have designed and developed solutions for hundreds of companies across the country, applications and mobile apps used by tens of thousands of users.

For your growing insurance firm, partnering with the right mobile app development company is transformative. PhoenixBizz, a division of Sofvue LLC and part of the Data Titan (datatitan.com) software division, stands apart as a premier provider in this space. With over two decades of industry experience and a portfolio of solutions for hundreds of clients coast-to-coast, we are well-equipped to meet your needs.

To learn more or to schedule an in-office or on-line appointment, call us at 623-845-2745.

Article ID: 11748

Citations

Precedence Research: https://www.precedenceresearch.com/artificial-intelligence-in-insurance-market

McKinsey & Company: https://www.mckinsey.com/industries/financial-services/our-insights/insurance-2030-the-impact-of-ai-on-the-future-of-insurance